How The Cost of Living Crisis Has Affected Scottish RSLs & Tenants

The current cost of living crisis shows no sign of abating and its negative impact on both social landlords and tenants are far and wide (as we have examined elsewhere on this blog). As inflation continues to rise most of us are feeling the pinch, however, it might surprise many but in the last twelve months there are 7% fewer tenants in arrears in Scottish social housing despite the cost of living crisis. However, this masks the true situation as research has revealed there are more tenants at risk of falling into arrears as the crisis progresses and that this particular group will be comprised of a new cohort that ‘don’t know how not to pay’ as we’ll examine further.

Tenants having to make already stretched incomes stretch even further has in turn impacted social housing providers as more fall into arrears and rental income is reduced. According to Joseph Rowntree Foundation, in 2021 before the cost of living crisis, the poorest quintile spend a combined 47% of their income on rent and electricity (28%), food (15%) and clothing and footwear (4%). It is expected that as the cost of living crisis continues, these essentials will account for a greater proportion of their spend, again having a detrimental effect on tenants ability to pay rent.

Scottish RSLs Outperform UK Counterparts

In Scotland the situation to date has been well managed; as mentioned, according to research by Mobysoft in the past 12 months, there are 7% fewer tenants in arrears. The same piece of research also reveals that In the last twelve months Scottish landlords have outperformed the UK averages, with their overall arrears falling by 3.78%. The arrears caseload also fell in line with drop of tenants in debt, by 6.76%.

However, Scottish social landlords face additional pressure in delivering the government’s strategy on Housing to 2040, when current rental income is frozen at April 2022 levels.

One of the main pillars of ‘Housing 2040’ is a well-functioning housing system that gives rise to sustainable communities. Part of the approach for delivering this in the government paper is ‘fairness’ for social tenants and a consideration that tenants are made aware that help with housing costs is available if needed.

Housing 2040

As a result, social housing providers in Scotland are having to mitigate both the effects of the above – more resources being required to deliver on ‘Housing 2040’ – as well as the cost of living crisis fallout. With the rent freeze imposed by Holyrood until March 2023, many organisations are adapting their business plans and re-forecasting in order to account for these additional deliverables.

For example, to de-carbonise properties (one of the tenets of the ‘Housing 2040’ strategy), Inside Housing estimates this will cost £20,742 per property. This figure was formulated before the cost of living crisis, and now spiraling inflation is pushing up supply side costs. Coupled with the rent freeze means that costs are rising faster than income and delivering Housing 2040 looks increasingly difficult.

An Increased Risk of Arrears for Scottish Tenants

The rise in the number of people working zero hour contracts and the continued roll out of Universal Credit (UC) has made it harder for many to budget as wages often fluctuate month to month. In Scotland the numbers on zero hour contracts rose by 11,000 in 2021 to 81,000.

Research by Mobysoft found that 40% of tenants who pay their rent by more than one method, such as UC payment and direct debit top up, are more likely to be at risk of arrears.

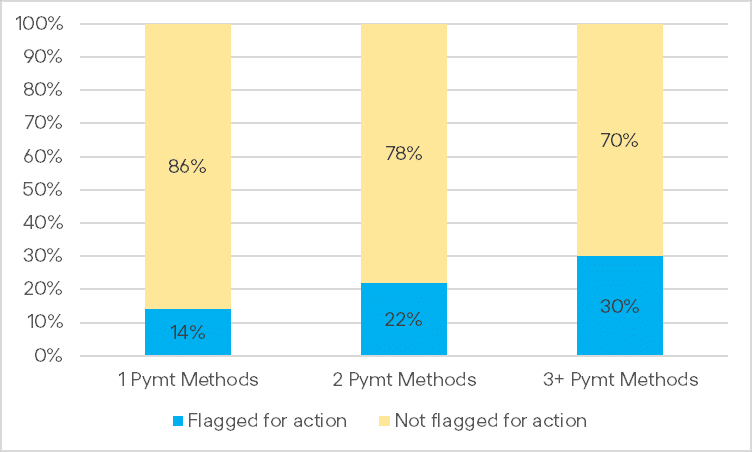

The 8% of tenants that pay their rent by 3 methods or more are twice as likely to be in arrears than tenants that pay by a single method, as outlined in the graph below.

How Multiple Payment Methods Impact The Risk of Arrears

There has also been an increase in the number of tenants who pay their rent via multiple methods – since January 2022 alone there has been a 6.8% increase in tenants paying by 3 or more methods.

Taking into account all of the above, it’s evident that RSLs have their work cut out to support their tenants in a timely, ethical and equitable way. Lower revenues mean that RSLs will be expected to do even more with even less, meaning that it’s never been more important to protect both tenants and rental incomes by identifying who needs support and when and intervening early to offer the appropriate support before they fall into debt.

Winter of Discontent?

As winter looms into view and tenants face rising heating and food bills their ability to pay their rent will be severely tested. Mobysoft is expecting to see a rise in the volume of debtors and a new ‘type’ of tenant in addition to the ‘can’t pay’ and ‘won’t pay’ cohorts; the ‘don’t know how not to pay’. These tenants, who have never before been in arrears, may look to pay their rent with credit cards, loans and the like.

This new group of debtors will undoubtedly result in more complex caseloads for housing officers and further stretch resources as more time will be required to support this cohort. Mobysoft’s own data points towards a significant number tenants now having their credit balance eroded – in March 2022 7.88% of tenancies across the UK had a reducing credit balance and were at risk of falling into arrears, this was a 11.51% rise on March 2021.

As such, there’s a pressing need for RSLs to create capacity within their housing teams to be able to support their tenants appropriately during what is shaping up to be a testing winter. At present Scottish landlords that use RentSense, their officers are completing 77%. If caseload does increase (it is expected to increase across all landlords) then RSLs will need to find ways to create further capacity.

Help Is At Hand

Mobysoft can provide social landlords with a Tenant and Income Risk Analysis Report. These bespoke reports forecast how the cost of living crisis will impact your tenants and your income, and provide insight that:

- Identifies which tenants and tenancy types are at most risk from the cost of living crisis

- Measures and benchmarks productivity

- Forecasts the impact on bad debt provision and cashflow

- Helps calculate the impact of the cost of living crisis on your strategic KPIs

- Provides projections on the final UC migration of tenants

- Offers insight and narrative from social housing’s largest dataset

If you are interested in obtaining a Tenant and Income Risk Analysis Report for your oganisation then fill out our contact form to learn more.

- This Month In Social Housing: September 2024 - September 30, 2024

- Customer Success Snapshot: Greatwell Homes - September 17, 2024

- This Month In Social Housing: August 2024 - August 30, 2024